Travel Blog

Simplified

Travel Blog

Simplified

Business Travel Trends in 2026: What’s changing and what to watch12th December 2025

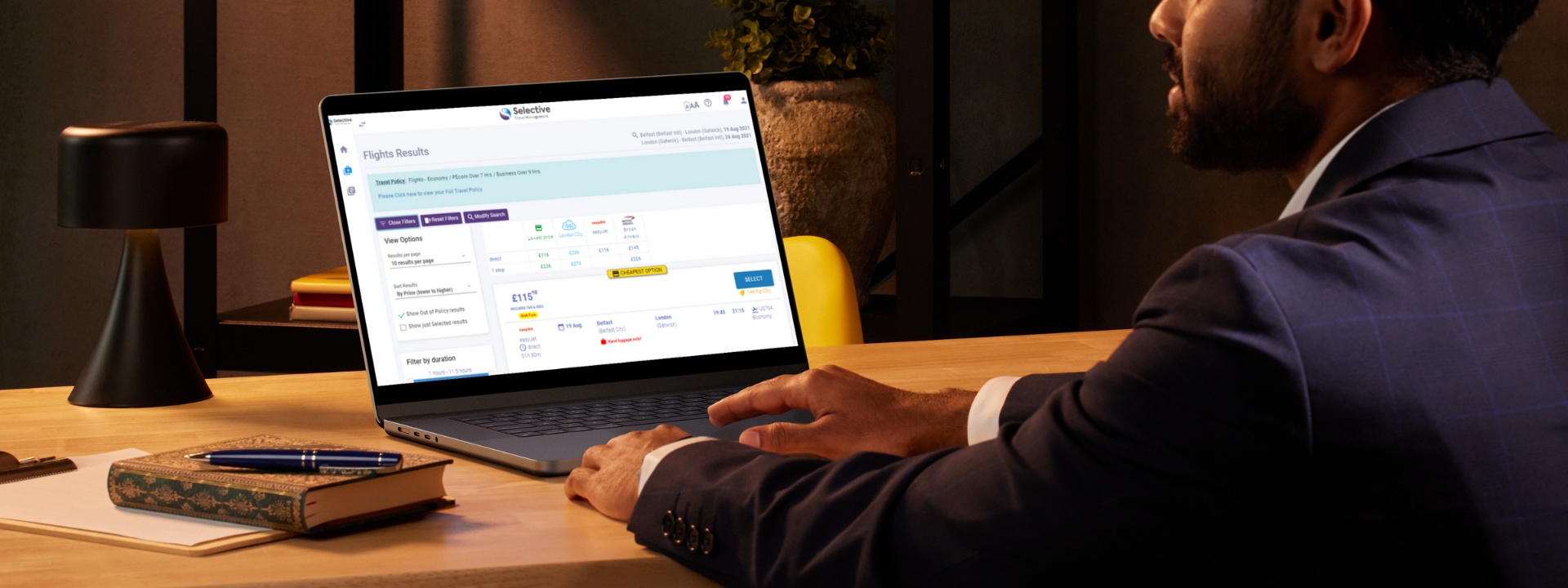

Business Travel Trends in 2026: What’s changing and what to watch12th December 2025In 2026, corporate trips are set to become more efficient, personalised, and impactful than ever before. Staying ahead of emerging trends will be key for...

Read More Top 5 Cities for Business Meetings & Events in 20263rd December 2025

Top 5 Cities for Business Meetings & Events in 20263rd December 2025As companies plan bigger, smarter gatherings for 2026, a handful of cities keep proving they have the mix of capacity, transport, hotels and hospitality infrastructure...

Read More Etihad Airways Dublin Double Daily19th November 2025

Etihad Airways Dublin Double Daily19th November 2025Etihad Airways have announced a significant increase in capacity on their Dublin to Abu Dhabi route, increasing frequency from 10 flights a week to double daily from 1 April 2026...

Read More Invisible Costs in Business Travel: What Most Companies Overlook18th November 2025

Invisible Costs in Business Travel: What Most Companies Overlook18th November 2025When organisations book flights and accommodation for business trips, the headline costs are obvious: airfares, hotel nights, ground transport. But for many travel programmes...

Read More The Psychology of Business Travel: How Business Travel Impacts Productivity29th October 2025

The Psychology of Business Travel: How Business Travel Impacts Productivity29th October 2025Business travel is often framed purely in logistical or financial terms - cost, schedules, destinations. But beneath the surface lies a more subtle dynamic: how hitting the road...

Read More

Business Travel Trends in 2026: What’s changing and what to watch

2025-12-12In 2026, corporate trips are set to become more efficient, personalised, and impactful than ever before. Staying ahead of emerging trends will be key for...

Read Moretravel-trends

Top 5 Cities for Business Meetings & Events in 2026

2025-12-03As companies plan bigger, smarter gatherings for 2026, a handful of cities keep proving they have the mix of capacity, transport, hotels and hospitality infrastructure...

Read Moretravel-trends

Etihad Airways Dublin Double Daily

2025-11-19Etihad Airways have announced a significant increase in capacity on their Dublin to Abu Dhabi route, increasing frequency from 10 flights a week to double daily from 1 April 2026...

Read Moretravel-news

Invisible Costs in Business Travel: What Most Companies Overlook

2025-11-18When organisations book flights and accommodation for business trips, the headline costs are obvious: airfares, hotel nights, ground transport. But for many travel programmes...

Read Moretravel-talks

The Psychology of Business Travel: How Business Travel Impacts Productivity

2025-10-29Business travel is often framed purely in logistical or financial terms - cost, schedules, destinations. But beneath the surface lies a more subtle dynamic: how hitting the road...

Read Moretravel-talks